As B2B SaaS companies pour out, it is no longer awkward to pay for and use software through subscription.

Following flat-rate subscriptions, the number of B2B SaaSs that apply the “consumption-based pricing” that pays as much as they spend has recently increased, and the stereotype that software is bought and used has collapsed a lot.

However, in terms of billing, it seems difficult to say that the SaaS ecosystem is balanced. Amid the trend that billing software cannot keep up with the evolving speed of SaaS products, there are many voices calling for rapid innovation in billing services that support SaaS.

Venture investment companies (VCs) are also ready to support startups that are trying to solve SaaS-related billing problems.

SaaS is pouring in, but Billing remains a paradigm in the era of the product purchase

VCs paying attention to SaaS borrowing means that there are many problems on this side. Digging into the root of the problem eventually leads to an uncomfortable reality, which is rough as follows.

Most of the billing systems on the market these days came before SaaS companies popularized their subscription models. According to protocol reports, existing billing systems are designed to focus on one-time product transactions and are not optimized for subscription models that continue to be used.

Bogomil Walkansky, a partner at Sequoia Capital, one of the leading venture investment companies in Silicon Valley, said, “The SaaS billing problem has been a problem since SaaS companies came out. “It’s interesting that it’s 20 years old, but Billing is still an operational challenge for SaaS companies,” he said. There is a strong nuance that billing surrounding SaaS is not an easy problem to solve in a short period of time.

According to related industries, some companies in the SaaS ecosystem are applying their own billing systems. But not all companies can do this. Especially for startups.

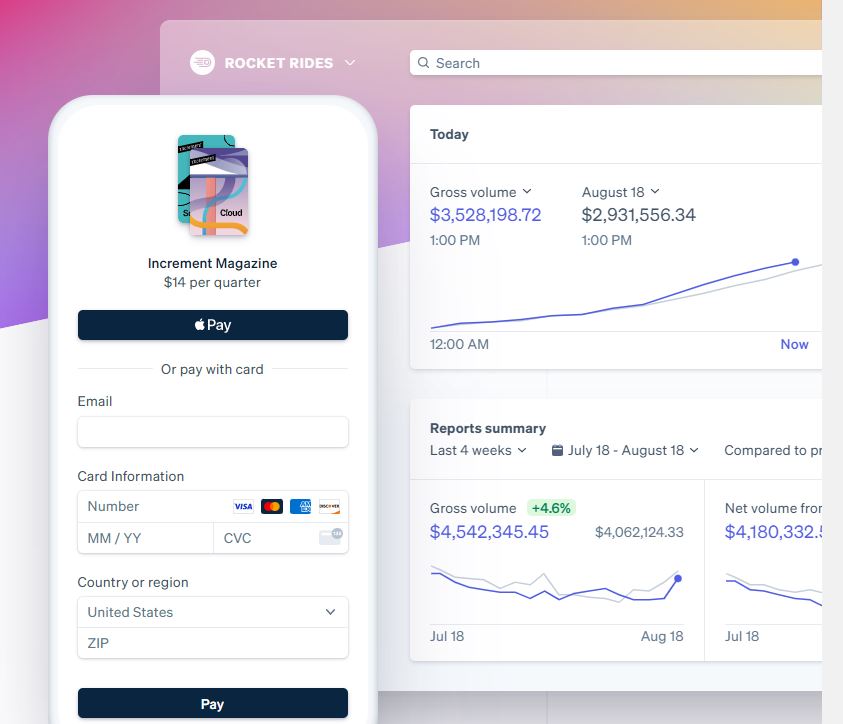

There are some commercial billing systems available for SaaS companies such as Zuora, Chargebee, Chargify, and Stripe, but there is still a long way to go. Some point out that these products do not go well with price structures such as pay-as-you-go systems. Not only does integration take a long time, but it is also less accessible in the enterprise environment, the protocol quotes industry officials.

A problematic situation is an opportunity for entrepreneurs who want to solve the problem. There is a series of news that companies with SaaS borrowing as their main specialty have attracted investment.

Metronome, which provides a platform that allows SaaS companies to apply pay-as-you-go models, has attracted $30 million in investment from Andersen Horowitz, and Chargebee, a subscription management software, has been recognized for $3.5 billion in company value.

SaaS Optics and Chargify have also attracted $150 million in investment from Battery Ventures.

Although promising players are emerging, rumors say that there are still not many clear options to choose from in practice. It seems realistic to see it as a stage of investing while waiting for the birth of an alternative.

SaaS-optimized billing has greater potential than finance or ERP

The big view of the weight of borrowing in SaaS is not just because it is directly related to sales.

According to industry sources, billing has a wide range of effects from product design to customer retention. It is also related to CRM, ERP, and communication systems used by companies.

In the meantime, as new SaaS price models continue to emerge, the complexity to manage in terms of billing is increasing. In the case of the pay-as-you-go price model, it is possible to operate only when you have the billing capability to accurately measure data on how much customers have spent on time, sometimes minutes.

Managing SaaS products at various price ranges is not easy. For example, if a customer uses a free product, the product must be managed so that the premium function cannot be used. Changing product management from time to time depending on what price model the customer uses may seem like little, but it can actually be quite a complex problem.

Currently, B2B SaaS companies utilize various price structures for services. Slack operates the service with a function-based pricing policy, and companies such as Salesforce receive monthly or annual subscriptions. In the case of Twilio, a pay-as-you-go price policy was applied.

Each price structure directly affects customer acquisition and sales growth. Depending on the business situation, there may be situations where the price structure needs to be changed, which may not be easy. According to a protocol article, when B2B SaaS companies introduce a new price model, the financial system must also change in conjunction, but not many places have such a system.

Against this backdrop, related industries are also speeding up their efforts to solve the problem. Stripe, which provides an API-based B2B payment platform, has also acquired Reco and Billflow in recent months and is aggressive in helping SaaS companies operate more flexible pricing structures.

Personally, I didn’t have much interest in Billing while writing about B2B SaaS. It’s true that I thought it wouldn’t be a big problem. But that is not the case. If innovation does not take place in Billing, it seems that the evolution of the SaaS ecosystem will be slow.

It can be seen that the potential of billing optimized for SaaS is that great. According to the protocol, Stripe’s Vladi Shunturov sales product leader went so far as to say, “I think Billing is bigger than ERP in the end.”

Looking at the atmosphere, various attempts and experiments related to SaaS billing are expected to increase in the future. Considering this, I will also regularly deal with SaaS issues from the viewpoint of billing.

#SaaSBillingSystem # #B2BSaaS #SaaSTrend #B2BSaaSCompanyAnalysis #B2BSaaSIndustrialTrend #B2BSaaSStartup #Chargebee #Metronome #Chargify #Stripe

by Sasquachi